Posts

Taxation is actually a generally-missed drag on the riches-building operate. Naturally, we all have been subject to income tax and you can conversion process taxation while the i secure and you can spend money, but the assets and you will possessions can be taxed. That’s as to the reasons you will need to understand their taxation exposures and you may make ways to get rid of the impact. The fresh Wealthfront Bucks Account are a hybrid membership that combines well-known options that come with each other examining and you may savings profile. You might open an account for only $step one and you can earn interest to the all balance.

Tariffs go for about and then make shopping on the web more pricey: ten simple workarounds

- When confronted with storms—getting it personal otherwise elite—which at the rear of principle lighting just how, permitting us to browse from tumultuous oceans to the redemption and you will resilience.

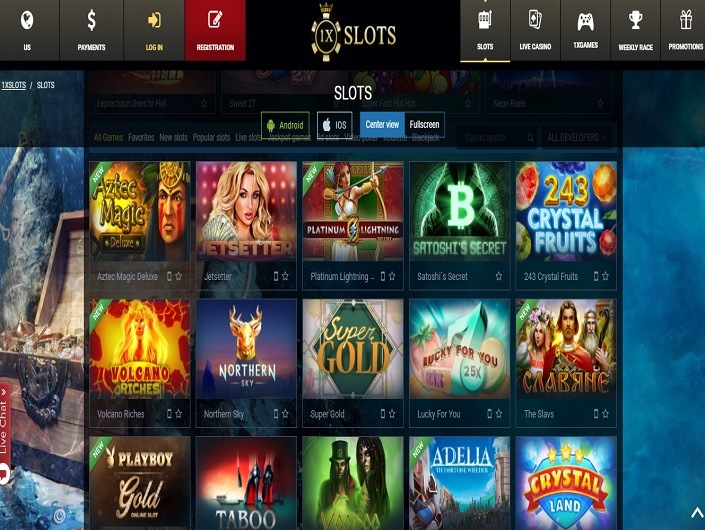

- There is certainly the new Affair away from Money online and cellular position during the our very own best-ranked web based casinos.

- That it development isn’t book to sporting events; it’s an expression away from wider public improvements.

Rising cost of living provides slowed down while the last go out it elevated borrowing from the bank will set you back (July 2023), plus the discount try appearing signs and symptoms of filter systems. The newest unemployment rates, such as, popped half of a percentage section away from very early 2023 in order to today. In addition to rising bank card delinquencies, there’s proof that the savings are decline. You to definitely integration–reducing inflation and you can a stagnating discount–’s the reason the new Given cut rates of interest from the you to definitely percentage section during the last several months from 2024.

Why should you Faith You: Experts’ Advice on Choosing the best Computer game

During the record, education might have been a travel push about ladies empowerment, wearing down barriers and you can beginning doors to potential that when searched out-of-reach. We are more than simply monetary advantages—we are protectors from family members, teachers whom empower, and alter-manufacturers changing lifestyle. Our very own performs happens apart from number; it’s on the carrying out shelter and potential in the event you believe all of https://happy-gambler.com/blood-moon-wilds/real-money/ us. Yet not, when we ensure it is interruptions, inconsistencies, or individualism to produce gaps in our unity, we deteriorate the collective strength. This type of gaps are not just small missteps—they’re able to deteriorate believe, diminish our very own impact, and then leave the people we serve insecure. As the management from the monetary wave, the shields are the knowledge i share, the fresh tips we implement, plus the believe i create having subscribers.

Simple fact is that appearing crushed to have advancement, the newest crucible to own reputation, plus the open canvas for the collective future. It invites all chief to write its chapter, to go out of the mark, and also to promote the next generation to broaden that it room also then. Sympathy is perhaps probably the most vital component of emotional intelligence inside the management. Empathetic leadership manage to discover the team’s requires, concerns, and you may ambitions, and this encourages strong relationships and you can a supportive place of work. By the respecting for each people member’s perspective and you may actively engaging using them, management can cause a people from inclusivity and respect where individuals feels read and liked.

Manage one gambling enterprises don’t have any minimal put?

Inside the a scene in which the financial surroundings is constantly developing, it is essential that your method evolves as well. Stay ahead of the new contour because of the constantly understanding the newest steps, following the newest equipment, and you will polishing your messaging. Innovation isn’t really entirely regarding the tech; it’s on the trying to find fresh, entertaining a method to apply at someone and then make complex financial concepts associated and you can accessible to her issues. By innovating the means, you not simply enhance the understanding sense as well as enable people for taking control over its economic futures with full confidence and you may quality.

By demystifying advanced monetary principles and you will providing basic, accessible degree, i permit household on the devices they must make safe and prosperous futures. The courses, categories, and you can information are designed not just to provide training but so you can encourage believe and you may encourage proactive economic method. From this holistic approach, i aim to manage a residential district in which somebody can be prosper, reach its enterprising needs, and you can certainly feeling their lifestyle and people of their family members.

With her, we can make a world where monetary fear is actually substituted for financial liberty. On the terms away from business person Elon Musk, “You have made paid-in direct proportion on the difficulty away from problems you solve.” For WealthWave instructors, the issue stretches past training earliest monetary literacy. It involves cultivating a perspective transform, strengthening individuals bring ownership of their monetary coming.

Ambition ensures that the organization remains at the forefront of the fresh industry, constantly trying to find the newest a way to educate and you may enable people within their economic excursions. Developing a premier-efficiency people is very important for riding organizational perfection and achieving an excellent results. This calls for mode clear performance criterion, implementing energetic recognition and you can prize options, and generating continuing understanding and invention. Management enjoy a pivotal character inside the fostering a host in which teammates is motivated to do well, be appreciated, and they are provided potential to have growth.

For example, if you try to help you put $step 1 and also the lowest endurance try $5, that’s in the event the message can happen. Discover minimum put amounts during the an online local casino or a great sweepstakes casino, you will want to go to the cashier point. Typically, there is so it regarding the top proper-give area from a casino application, but it will often enter another corner of the display screen otherwise the underside other diet plan. Casinos on the internet are expected by law to list the the personal data (talking about also known as Understand The Consumer regulations, or KYC regulations).

During the WealthWave, we’re also to your a mission in order to connection the new financial literacy pit. You can expect the education many people was never ever trained at school—degree one to’s necessary for to make smart financial choices and building long-term wide range. Because of the guides, courses, websites, and something-on-one to training, we make clear the causes of money for the simple, actionable knowledge one to you can now discover and implement. Today’s world offers progressive-go out Alexanders—leaders around the marketplace whose push and you will determination put the new bar to possess success.

- They seek advice however, continue to be stuck inside old patterns, hesitant otherwise unable to exercise.

- This method not simply generates faith plus fosters a lot of time-label dating one to become the foundation of your own company gains.

- These cashbacks are often provided every week and you can reflect a share that may change from between step one% to over %20% go back from your bets for that few days.

- Although not, such really pressures can be the brand new stepping stones to your greatest victory.

- Which gap departs someone vulnerable, have a tendency to to make vital monetary conclusion according to misinformation, trial and error, or tough—inaction.

$ten minimal put casinos

Carrying this out credential isn’t only regarding the improving you to definitely’s certification; it reflects a-deep dedication to monetary knowledge and you will ranking frontrunners because the respected specialists in our very own world. It is a testament to their commitment to lifelong understanding and you will top-notch brilliance. The story from monetary degree and literacy may sound unchanging from the its key, but their importance try timeless and ever-developing. In the today’s quick-moving globe, in which financial demands such inflation, debt, and you may money risks are becoming all the more complex, the fresh crucial to work to the financial degree is not better. Training rather than action is actually at some point worthless; it is just because of bringing concrete, informed actions that folks is also it really is secure the financial coming. Navigating the complexities of contemporary financing will be challenging, especially for those who are a new comer to monetary literacy or facing difficult points.

This approach emphasizes the significance of emotional involvement in the changes process, since the ideas is powerful vehicle operators away from conclusion. Undertaking an effective emotional link with the alteration is essential to possess cultivating partnership and you can determination one of people involved in the change. WealthWave cities members at the center of all things they actually do, acknowledging you to definitely its success try intrinsically linked to the satisfaction and well-getting of its clients. That it customer-centric philosophy means that the procedures and strategies is actually carefully constructed on the client’s needs in your mind, fostering a love built on believe and cooperation. We could pertain complete informative applications, power technology to reach diverse populations, and promote partnerships one to offer our reach.