Content

The newest accounting speed from return (ARR) try a financial metric used to assess the profitability away from an enthusiastic funding. It casino gladiator is computed by separating the common annual profit by the fresh 1st money and you may stating it as a percentage. In this instance, the newest project’s mediocre yearly funds are bad (-$60,010), demonstrating that the venture is not producing confident efficiency.

- Come across information regarding Atomic Brokerage within their Mode CRS, General Disclosures, percentage agenda, and you will FINRA’s BrokerCheck.

- Yet not, fairness with regards to price is a different design and may never be guaranteed.

- The fresh Mug-Steagall Operate try repealed inside 1999 in the middle of much time-position matter your restrictions it implemented to your banking field had been unhealthy and this making it possible for financial institutions in order to broaden create get rid of risk.

- Centered on Hamza, law enforcement were in addition to yelling gossip that people getting detained was out of Hamas “and attended to remove Cairo.

Casino gladiator | JPMorgan and you may Deutsche Lender Get in on the Chorus

Such advancements through the amplification from questions thanks to social network and you can the speed of a few depositor responses, the fresh interaction from failure-quality situations and depositor decisions, and the improved frequency and you will proportion from uninsured deposits in the bank system. What the Wall surface Path Diary features done with it report is to open a good Pandora’s container concerning your vast sums from international dumps stored in the foreign branches out of JPMorgan Chase and you may Citigroup’s Citibank – nothing at which try protected by FDIC insurance. They after that raises the concern as to the reasons the new financial bodies of the two Wall Street super banking companies features welcome so it hazardous state to happen. “This from the America’s premier banking companies reflects their trust within the Basic Republic along with banking institutions of all of the types, also it demonstrates their full dedication to helping banking institutions serve the customers and you will organizations,” the team told you within the a statement. “This action from the America’s premier banking institutions reflects their rely on inside Basic Republic as well as in banking companies of all the brands, and it demonstrates the total commitment to helping banks suffice its users and you will groups,” the group told you in the a statement. Compare one for the national average family savings rate from 0.46% APY and you can see that you might secure somewhat a bit more because of the placing your bank account inside the a top-investing bank account.

That it statement shows that whilst the complete interest in grain provides not changed, extent required features reduced to some extent consequently of the rate improve. While the prices have increased, consult hasn’t altered however, amounts demanded features fallen particular. The fresh mention of the “undetectable give” means the concept of industry pushes, where correspondence of have and consult determines prices. Considering that it report, the fresh hidden hands can be regarded as the new driving force trailing the new ascending grain costs. Following stock market freeze inside 1929, more 9,100 banking companies in the us failed across the 2nd four ages.

When they do it safely, they’ll manage to get thier honor with regards to a large extra. Consultative membership and functions are provided by Webull Advisors LLC (also known as “Webull Advisors”). Webull Advisers try an investment Coach entered which have and managed from the the newest SEC within the Funding Advisers Work away from 1940. Deals on your Webull Advisors account are executed because of the Webull Economic LLC.

An increase or loss in an exchange is going to be filed due to activity in return prices. Because the yen depreciates prior to the united states buck, Badel could make a gain to your exchange. Since the money flexibility from consult is actually negative, it means one to oranges are a consistent a great. Yet not, the newest magnitude of your own suppleness (-0.8) means that the brand new interest in oranges can be a bit inelastic. Put differently, a 10% escalation in money leads to a keen 8% reduction of the newest need for apples. We could ending you to definitely apples are a consistent a great that have an income flexibility of request of just one.2.

GameStop Narrows Q2 Losings while the Bitcoin Holdings Improve Balance Piece

This will encompass offering book services or characteristics, carrying out customized invitees knowledge, focusing on a specific customers part, or leveraging technical to add imaginative characteristics. The brand new income tax impression idea postulates one buyers have a tendency to prefer straight down bonus money should your tax rates on the investment gains are less than the fresh income tax cost to your dividends. Hence, Peterson and Peterson Business may go through lowest demand for bonus percentage whether it principle keeps. A forward price arrangement (FRA) try a profit-paid more than-the-restrict bargain anywhere between two functions, and that promises the newest sale otherwise acquisition of a main asset, including a bond otherwise financing, during the a predetermined interest rate and also at a certain coming go out. It’s useful for hedging and you can speculation to your interest rate movement. Advantages of Loans FinancingThe cost of financial obligation investment is generally straight down than the cost of security money.

Team

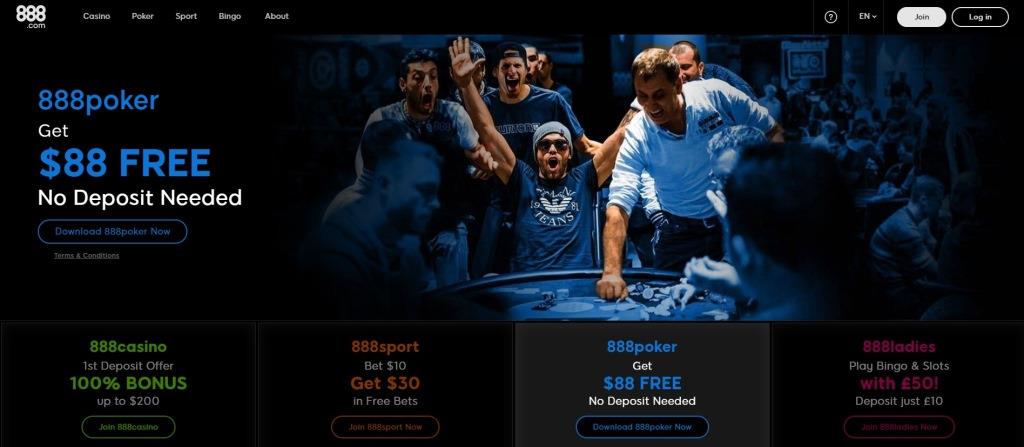

It has more 5,000 gambling games and an intensive sportsbook, making it possible for people to help you gamble and you may choice using many different cryptocurrencies, and $WSM. The pressure to the NYCB’s procedures and success in the midst of increased interest rates and an excellent murky mentality to have mortgage defaults features increased concerns while the to if or not NYCB, a serial acquirer of financial institutions up until now, might possibly be compelled to promote by itself in order to a more secure mate. The new disclosure try a “significant concern you to suggests borrowing costs might possibly be highest to possess an enthusiastic prolonged several months,” Raymond James analyst Steve Moss said Thursday within the a study note. “The newest disclosures increase our anxiety about NYCB’s focus-merely multi-family portfolio, that could require a long exercise period until rates of interest decline.” The amounts one to a particular depositor provides in a single or more membership within a single form of ownership class in the just one kind of financial is actually added along with her and so are covered up to $250,100. To love Robinhood’s very first complimentary inventory offering, you should use among their marketing hyperlinks and then fund your account with the absolute minimum deposit of $ten.

During the two banking crises—the brand new savings and financing crisis as well as the 2008 financial crisis—the newest FDIC expended the entire insurance rates money. Just as with deals and money field accounts, starting a great Video game having an FDIC-insured bank otherwise NCUA-insured borrowing relationship have a tendency to include your own fund in case your establishment goes wrong, and make Cds almost chance-100 percent free. To store anything risk-free, just make sure the brand new high-give family savings you open was at sometimes a financial that’s insured by Government Deposit Insurance policies Business (FDIC) or a credit connection covered from the Federal Credit Relationship Management (NCUA). From the staying with representative organizations of the two federal firms, their dumps of up to $250,100000 for each and every institution might possibly be secure on the impractical enjoy one to the lending company or borrowing from the bank partnership fails.

The new disaster laws which had been passed within this days of Chairman Franklin Roosevelt getting office inside February 1933 was just the beginning of the procedure to change believe on the banking system. Congress noticed the necessity for nice change of your banking system, and this eventually came in the newest Banking Act of 1933, and/or Mug-Steagall Work. Cup, an old Treasury assistant, is the key push trailing the brand new operate. Steagall, up coming chairman of the home Banking and you can Currency Panel, offered to hold the work which have Mug after a modification is actually put into allow bank put insurance rates.step 1 To your Summer 16, 1933, President Roosevelt finalized the bill for the laws. Glass to start with delivered his banking change expenses inside the January 1932. It received comprehensive reviews and you may statements away from bankers, economists, and also the Government Set aside Board.

The brand new bad ARR shows that your panels isn’t appointment the newest expected income membership to pay for the expenditures and you can make a profit. Ahead of the passage of the new act, there have been zero constraints off to the right out of a financial administrator out of a member lender in order to obtain from you to definitely bank. A lot of financing in order to financial officials and you will administrators turned something to help you bank authorities. In reaction, the fresh work banned Federal Set-aside member loans from banks on the administrator officials and you may expected the brand new installment away from a fantastic finance. 55 Wall Street’s granite act includes two piled colonnades against Wall structure Path, per having 12 columns.

Online casinos favoritos de VegasSlotsOnline

Next techniques means you will get their 1st 100 percent free share valued between $5 and you may $200. Robinhood try powering a free stock venture to your day away from Sept, 2025, providing new registered users up to $step one,700 within the 100 percent free stock in their first 12 months. To take advantageous asset of that it offer you have to discover and you can financing your account which few days as eligible; Robinhood alter its promos frequently referring to an educated i have ever seen from their store. Purchase the has one number really for your requirements, in addition to travelling advantages, benefits points, and.

XRP Rallies 8% from Daily Lows because the Organization Volume Forces Rate Over $step 3

Several financial institutions have agreed to put $31 billion inside the Very first Republic inside the what is supposed to be an excellent manifestation of trust regarding the banking system, the banks announced Thursday mid-day. To awaken the fresh mega banking institutions on the Wall structure Path on their own vulnerability which have uninsured deposits as well as security the fresh DIF’s losings, the brand new FDIC put out a proposition on may eleven to levy a unique analysis in accordance with the private lender’s holdings away from uninsured dumps by December 29, 2022. The new analysis manage add up to a charge away from 0.125 percent of a lender’s uninsured places more than $5 billion. The greatest APY savings membership aren’t the of them to the large interest rates if you don’t care for an equilibrium out of not all the thousand cash. SoFi are attractive to the newest otherwise college student buyers, thanks to the affiliate-friendly platform and you may range of products, and financial accounts and you may informative meetings.

Don’t Song is a thing you to’s a good idea theoretically, however, the one that hasn’t proved helpful in practice. There are many more actions, but these would be the simple recording devices at the creating. Understanding and that privacy gizmos to use depends on and you will one to ones something’re concerned with being individual. Program effect and you may membership availability moments can differ due to an excellent sort of issues, as well as change amounts, market conditions, system efficiency, or any other items.

Having Varo’s checking account, your own base interest rate initiate in the 3% APY. But hold off an additional—you can purchase an excellent 5% APY raise for individuals who satisfy which bank’s requirements. Written down, Varo gives the very glamorous APY that have a great 5% focus family savings, however, you to’s maybe not technically an informed deal. NerdWallet’s full opinion processes assesses and you can ranking the biggest You.S. agents by possessions less than administration, along with emerging globe players. Our aim should be to provide a separate assessment out of business to let case you with advice and then make sound, informed judgements about what of these usually best be right for you.